Maple’s Cash Management Solution now operates with a Reg D exemption so U.S. domiciled Accredited Investors and Entities can confidently access a conservative yield backed by U.S. Treasury bills on-chain. Since the pool launched to non-U.S. customers in April, over $27 million USDC has been deposited to the Cash Management USDC pool, returning Lenders an average of 4.67%.

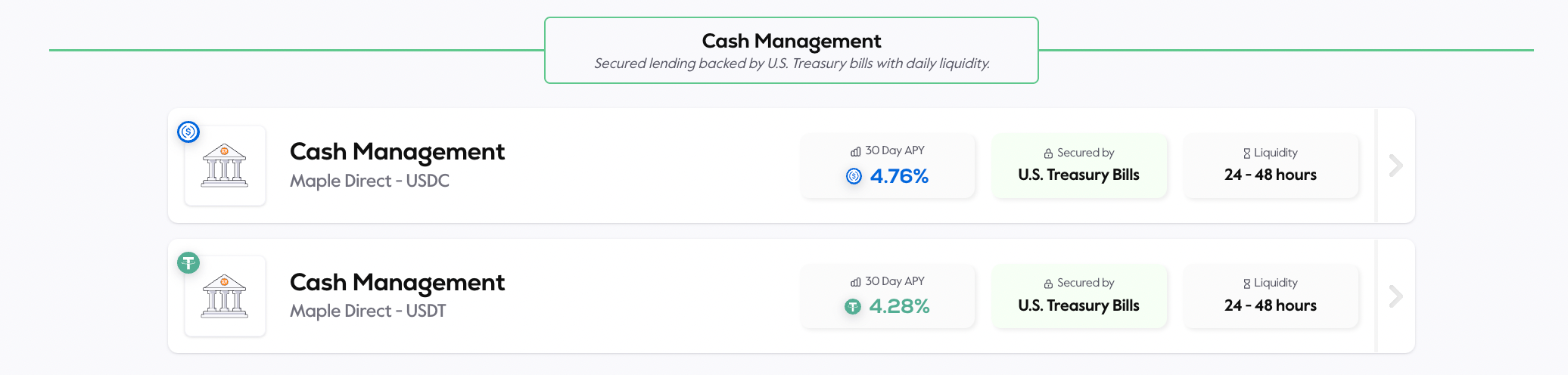

The Cash Management Pool is a highly liquid treasury management solution for Web3 treasuries, digital asset funds, and DAOs to remain on-chain and access conservative yield backed by U.S. Treasury bills and reverse repurchase agreements. The Pool targets a net APY of the current 1-month U.S. Treasury bill rate, less fees totaling 0.5% annualized.

The structure provides Lenders with the most direct access to U.S. Treasury Bill rates on-chain, recourse to Treasury Bill collateral without ETF liquidity or depeg risks, and because there are no inbound or outbound fees, the freedom to upsize or withdraw next-day. As a result, nearly 60% of lenders have increased their positions, with an average position increase of approximately 360%.

If this sounds like the cash management solution you’ve been looking for begin onboarding here.

For Relm Insurance, it’s the daily liquidity of the pool which attracted them to the Cash Management pool. As a licensed and regulated insurance firm, their ‘top priority is ensuring capital is safe and accessible to meet potential claims’ and since launching, daily liquidity on U.S. banking days has been maintained. More than $6M in withdrawals have been serviced within one business day allowing lenders to quickly access their capital to take advantage of market opportunities, meet operational expenses or in the case of Relm Insurance, meet customer claims.

Visit the Cash Management - USDC pool: https://app.maple.finance/#/v2/lend/pool/0xfe119e9c24ab79f1bdd5dd884b86ceea2ee75d92

Key features of the Cash Management USDC pool:

- Confidence with compliance: Whilst Maple takes the view that the Pool is not a sale of securities, the pool now operates with a Reg D exemption to provide Lenders with more confidence with compliance.

- No in or outbound fees: The pool passes the 1-month U.S. Treasury Bill rate, less fees, to Lenders. There are no in or outbound fees and fees of 50bps are annualized and paid on interest earned.

- Immediate interest and next-day withdrawals: Interest accrues from the time of deposit which differentiates the Cash Management Solution from most other offerings. The pool is designed with its customers’ needs in mind - so Lenders can manage cash flows there’s no lock-up period and withdrawals are serviced the next U.S. banking day.

- Established, transparent infrastructure: Maple’s superior smart contract infrastructure has processed billions in transaction volume and provides constant, verifiable, on-chain information not subject to manual input or manipulation.

- Monitor and measure performance 24/7: Lenders have a real-time view of the borrower’s portfolio of assets held with a regulated broker. Lenders can see the holdings and the maturity ladder of short-dated bills and reverse repurchase agreements by simply visiting the pool on app.maple.finance.

- Familiar structure provides the most direct access and recourse to Treasury Bills: Lenders are attracted by the most direct access to U.S. Treasury Bill rates on-chain and recourse to Treasury Bill collateral. Treasury bills are backed by the full faith of the U.S. Government and are considered one of the safest forms of debt around.

- Managed with leading 3rd parties: Room40 Capital, an institutional crypto hedge fund, has established a stand-alone SPV to be the sole borrower from the pool. The team has decades of operational and trading experience in the US Treasury market. The Room40 Capital team trade, custody and clear from an account with regulated broker StoneX. Maple has a track record in providing secure and scalable products on top of best-in-class smart contract infrastructure and was recently awarded a 92% Safety Score by DeFi Safety [full report].

Maple is committed to providing access to financial products on-chain and continues to launch new and diverse yield opportunities to suit the risk, liquidity, and compliance needs of institutional and individual investors across the globe. Expanded access to Cash Management for U.S. domiciled Accredited Investors comes quickly after Maple launched a USDT denominated iteration of Maple Cash Management where non-US lenders can earn yield backed by U.S. Treasuries directly in their preferred stablecoin. Visit pool.

Onboarding should take 10 minutes for an Accredited Investor to complete the forms and 15 minutes for an Accredited Entity. It’s a 3 step process that includes:

- Completion of the 'Lender Onboarding Form': This is Maple's standard onboarding form and takes on average 2 minutes to complete. Begin onboarding here.

- Submitting KYC documentation: Standard documentation including proof of identity, address, income and entity. On average this takes 3 minutes for an Individual to complete and 9 minutes for an Entity.

- Signing the 'Lender Attestation': Whilst T&Cs need to be signed we have digitized and simplified the process and copy to be easily understood by all applicants.

ABOUT MAPLE FINANCE

Maple provides the infrastructure for credit experts to run on-chain lending businesses and connects institutional lenders and borrowers. Built with both traditional financial institutions and decentralized finance leaders, Maple is transforming debt-capital markets by combining industry-standard compliance and due diligence with the transparent and frictionless lending enabled by smart contracts and blockchain technology. https://maple.finance/

ABOUT ROOM40

Room40 is an institutional investment firm focused on crypto. Our mission is to partner with builders developing tomorrow’s user experience through new economic design and financial operating systems. The firm manages dedicated strategies for private and public crypto markets, allowing Room40 to deploy capital across the lifecycle of digital assets. Room40 Capital is the firm’s multi-strategy hedge fund. https://www.room40.capital/